Marriage marks a significant life transition by uniting two people in a relationship that lasts a lifetime.

However, when disability enters the picture, it might provide additional challenges and concerns that unexpectedly change marriage rules, especially for disability benefits.

It’s a common misconception that SSI or SSDI benefits recipients lose their eligibility once they tie the knot. A foundational understanding of social security law is vital to grasp marriage’s implications on benefits fully.

The present article discusses the effects of disability on marriage rules and laws, health care, and financial concerns.

Impact of Disability And Marriage Rules

The Social Security Administration has two programs, Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI), to provide financial support based on long-term disability.

These programs not only make one eligible for benefits based on their health status but also consider their financial situation and marriage. Because getting married also changes the resource for personal expenditure, SSI or SSDI benefits will likely be affected.

It’s important to distinguish between SSDI and SSI before discussing the impact of marriage on disability benefits.

A video that explains how marriage affects the SSDI and SSI benefits of disabled people if they decide to marry.

Supplemental Security Income (SSI) Benefits

In the United States, the Social Security Administration runs the Supplemental Security Income (SSI) program based on financial need. Disabled people with limited resources and few assets are eligible to qualify for SSI benefits.

If a person receiving SSI benefits gets married, both partners’ income and resources are factored into the eligibility calculation and the benefits received, which can make or break the deal.

Getting Married While on SSI Disability

Getting married does not terminate SSI eligibility, but understanding the program is crucial to avoiding losing disability benefits.

In contrast to SSDI, SSI does not consider a recipient’s earnings history when determining eligibility. Instead, there are constraints on a recipient’s income and resources under the SSI program.

One Receives SSI benefits, and the Other Doesn’t

If one receiving SSDI benefits gets married, a portion of the spouse’s income will be “deemed” (or treated as if you owned it). Part of the spouse’s earnings are considered equal by the Social Security Administration (SSA) if they come from:

- Paychecks or Salaries

- SSDI payouts, side business, or freelancing compensation,

- Other sources of regular monthly or annual earnings.

A recent example is Mark and Lisa. Mark was getting SSDI benefits due to his inability to work due to a disability. His job and salary history were used to calculate his monthly benefit. When they married, a part of Lisa’s income was deemed Mark’s after considering the combined household income, and the benefits were adjusted accordingly.

If The Non Disabled Spouse makes less than about $5,500 per year.

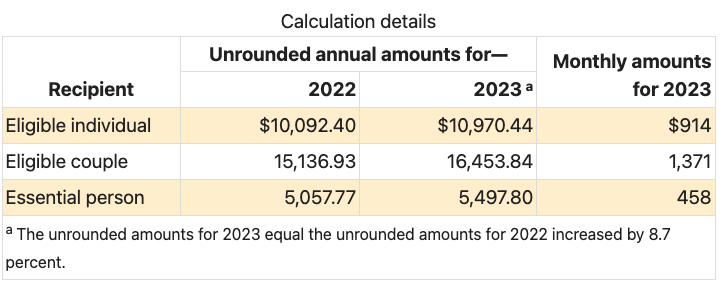

The Social Security Administration won’t consider a certain amount of most minor income, which is $457 per month or $5,500 per year for 2023 if they don’t own any children. If they have one kid, the figure rises to $914; if they have three, it rises to $1,371; and so on.

If a Non-Disabled Spouse Earns More than $5,500/ year.

If a non-disabled spouse’s monthly income is more than $457 in 2023, the result will be in the shape of a disabled person losing benefits.

For example, if the non-disabled spouse earns $48,000/year, SSI benefits would cease as they exceed the SSA threshold. Similarly, a spouse makes around $24,000/ year, about half of the average worker in the U.S. Then SSI revenue would go down to a monthly payment of about $300, a 64 percent cut. In brief, the disabled spouse will not be eligible for SSI if the couple’s total countable income (after some substantial deductions) is more than $457 monthly.

If Both Receive SSI Benefits.

Suppose two people receiving SSI benefits get married. In that case, their individual benefits will be changed to the couple’s benefits, and there will be a 25% deduction from the combined benefits they had before marriage.

It can be because couples may survive on less money together than individually, which is considered a marriage penalty. In 2023, one individual will get $914 ( $1,828 per month for both) from SSI, while a married couple will receive $1,371.

ven if not legally married and live together, they may be considered a couple under the SSI definition and be subject to the same rules and criteria as married couples, resulting in reduced benefits.

Let’s consider the real-life example of John and Mary, who are both disabled and get SSI payments. When they got married, however, their combined earnings were too much money for them to qualify for SSI. Therefore, their SSI payments are altered as marriage penalties, which may result in a decrease or even the loss of their benefits altogether.

Disability benefits specialist Roy Rickstrew explains how a marriage can affect the SSI benefits received.

Social Security Disability Insurance (SSDI)

Disability benefits under the SSDI program are available to anybody who has worked and paid into the Social Security system and who becomes disabled in the future.

Such benefits are determined solely by their work credits and records because the beneficiaries’ previous jobs determined these SSDI payments. With no consideration given to the spouse’s income, getting married will never affect those benefits.

Getting married can only affect your monthly benefits if you receive payments based on someone else’s record. Such as in the below-mentioned cases,

Child benefits

If the parent received SSDI or passed away while receiving SSDI, one may be eligible for dependent benefits if the child is 18 or younger.

The benefits terminate when a child receiving Social Security benefits on their parent’s record gets married. The particulars are as follows:

- A child/stepchild of a disabled worker who is 18-19 years old, if enrolled in high school or married, is eligible for benefits.

- Unmarried adult disabled children of disabled workers can get benefits until they recover or marry if their disability began before they were 22. However, marrying another disabled adult child may not affect benefits.

For more information on benefits provided by SSDI for children, refer to our article on disabled adult child benefits.

Divorced Spouse Disability Benefits

If an individual receives benefits based on their ex-spouse’s income record and decides to get married, they will no longer be eligible for government benefits.

An ex-spouse of a disabled worker who is 62 or older and has been divorced for at least ten years is an exception to this rule. If the ex-spouse does not remarry, they can get benefits until death.

But What happens if you divorce a disabled spouse? Our article may help you understand the various concerns that may arise during such a divorce.

Divorced Spouse Surviving Benefits.

If a surviving ex-spouse remarries before reaching a particular age, they will no longer be eligible to receive benefits on the record of her or their deceased, disabled partner.

If a divorced surviving spouse remarries beyond the age of 60 (or 50 if they are disabled), Social Security won’t include the marriage as a new qualifying event.

Widows and Widowers Benefits

If they meet the criteria as an eligible family member, widows and widowers can continue to receive benefits from their deceased spouse’s disability insurance policy.

If a person receiving continued benefits based on their disabled deceased spouse’s income chooses to remarry before age 60, they will be required to forfeit SSDI benefits.

Likewise, if a disabled person marries before age 50, their benefits will be reduced because their new spouse’s income will be used to cover their health care and expenses.

Another video explains the marriage rules and disability benefits.

If You Get Married and Receive Both SSI and SSDI Benefits

If a person receives social security disability benefits and SSI each month, they receive “dual” or “concurrent” benefits. In cases of concurrent SSDI and SSI benefits, marriage may result in the loss of SSI benefits.

However, even after marriage, the SSDI benefits won’t be changed, as the individual’s own earnings serve as the premise for SSDI benefits.

Medicare And Medicaid Benefits

Eligibility for Medicaid is determined by a person’s financial situation, which includes income and assets; even a couple’s combined assets are also considered (Limits are set at $2,000 for a person and $3,000 for a couple).

A spouse earning too much money or having too many assets might hinder their eligibility for Medicaid benefits.

Whereas in the case of Medicare, age and disability, rather than marital status, are the primary criteria for Medicare eligibility. The Medicare coverage of one spouse does not affect the other spouse’s coverage.

Similarly to disability benefits, personal retirement benefits will not experience any fluctuations upon getting married.

Conclusion

A person may apply for SSDI benefits even if their spouse continues to work. Social Security benefits and other financial aid forms may be affected after marriage. Factors including the duration of employment and payment of Social Security taxes will determine the application’s fate.

To fully grasp and understand the changes, it is recommended to speak with a financial counselor, disability lawyer, or appropriate government organization. Prenuptial agreements and other legal safeguards can help couples secure their financial futures and safeguard their rights.