When an individual cannot work due to a severe and long-lasting medical disability, they may be eligible to receive payments from Social Security Disability Benefits or insurance.

These benefits offer financial assistance to those unable to support themselves.

It is estimated that about 8.2 million people, including about 104,000 spouses and 1.4 million children, benefit from Social Security disability benefits.

So, what are reasonable expectations for disability beneficiaries? The guide will provide complete insight into these disability benefits.

Let’s work out the numbers together.

Importance of Social Security Pay Chart For Future Planning

Familiarity with the Social Security disability benefits pay chart is vital for financial preparation, as these benefits may make a difference in the lives of people with disabilities.

It helps calculate when to retire based on projected retirement income and the security of one’s financial situation. The information can help you maximize your spousal and dependant benefits and long-term budgeting efforts. Even so, it can be an excellent source for calculating social security retirement benefits.

Ultimately, it gives people more control over their financial lives and futures.

Eligibility for Social Security Disability Benefits

You must fulfill the following requirements of the application process to be eligible for SSD benefits:

- Work-Based Eligibility- To qualify for Social Security Administration (SSA) disability payments, you must have worked for several years before being disabled.

- Medical-Based Eligibility- The inability to work due to a physical condition prevents you from engaging in “substantial gainful activity.” the inability to work must have lasted at least 12 months or resulted in death.

- Work Credit Requirements- You must have paid sufficient Social Security taxes to qualify for benefits. In addition, the minimum amount of work credits depends on your age when you turn disabled.

The Social Security Administration thoroughly considers each claim by looking at medical records, employment records, and other data, and it usually takes five months for the application process to be completed.

During the five-month SSDI waiting period, low-income applicants with little or no assets may be eligible for Supplemental Security Income.

Calculation of Social Security Benefits

Once accepted as an SSDI recipient, you may use the details below to estimate how much money you’ll get in benefits and when you can expect to start receiving payments.

Let’s split the Social Security Disability Pay Chart into its constituent parts so that you may get greater clarity on it.

Determining the Average Indexed Monthly Earnings (AIME)

The AIME is a significant consideration when figuring out how much funding you’ll get from Social Security, which is the average lifetime earnings of your work period.

The Social Security Administration (SSA) calculates the AIME based on your highest-earning years, usually 35 years of service.

Inflation is considered throughout the indexing process to reflect a person’s lifetime earnings accurately.

Primary Insurance Amount (PIA)

Once you’ve determined your AIME, it determines your primary insurance amount (PIA).

The PIA is the monthly total benefit amount to which you are entitled once you attain the age of complete retirement. It is calculated using your AIME and updated yearly to account for inflation.

Check the Social Security Administration’s online disability benefits calculator to see what you could be eligible for.

Applying Bend Points

The Social Security benefit formula utilizes bend points to determine the proportion of AIME contributing to PIA. These adjustment points are recalculated annually to account for variations in the national average wage.

The formula applies various percentages to distinct AIME ranges. For instance, a higher rate could be applied to the portion of the AIME up to the first bend point, while a lower percentage could be applied to the segment between the first and second bend points.

The following formula is used to compute:

- 90% of your first $1,295 in AIME

- 32% of your AIME ranging from $1,295 to $8,185

- 15% of your AIME in excess of $8,185

The main insurance amount is calculated by taking a percentage of your AIME and multiplying it by three predetermined earning thresholds (also the “bend points”). 90%, 32%, and 15% are the required percentages by law. However, these thresholds adjust every year.

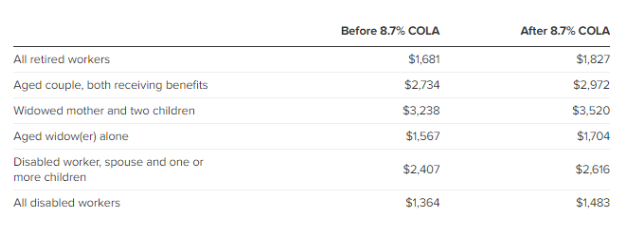

Cost of living adjustment (COLA)

To help individuals keep up with the growing cost of living, the government frequently increases the amount of money they get in benefits or payments, known as COLA.

The CPI-W, or Consumer Price Index for Urban Wage Earners and Clerical Workers, determines these adjustments. The Bureau of Labor Statistics updates the CPI-W every month.

For 2023, cost-of-living adjustments (COLAs) of 8.7 percent to the monthly benefit amount 2023 up to more than $140 per month. It is a substantial rise from the 5.9% COLA of the previous year.

Disability Insurance Benefit (DIB)

Disability Insurance Benefit is calculated by your Primary Insurance Amount (PIA), usually computed using your AIME.

But it’s important to remember that DIB payouts sometimes differ from your PIA.

In particular, the Social Security Administration’s specific calculations and procedures may be complex, and each individual’s situation may be unique.

The best thing is to create an account on the Social Security Administration’s website or meet with a financial advisor specializing in retirement planning. It is the most accurate way to estimate your Social Security disability benefits.

Determining Monthly SSDI Payments

The Social Security Administration uses a formula to determine your monthly SSDI benefits.

You need to have worked and paid Social Security taxes for at least five years during the past ten years to be eligible for Social Security Disability Insurance benefits.

You won’t qualify for the benefit if you have paid into the system or worked the equivalent of five full years.

There are several other ways to determine your PIA to receive benefits from the Social Security Administration:

- Use the Social Security Administration’s Online Benefits Calculator

- Create an account on myssa.com

- Call your local SSA office or dial 1-800-772-1213

Determining Monthly SSI Payments

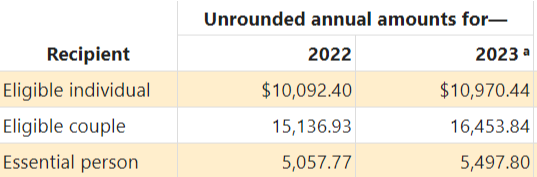

Supplemental Security Income (SSI) is for individuals with minimal or no income and is a welfare foundation. It provides payments for basic needs. Payments for SSI are based on the maximum federal benefit that the law establishes annually.

Only the limits that are required are mentioned below.

- Individuals must have assets of less than $2,000 to qualify.

- A married couple must have assets of less than $3,000.

The highest monthly SSI Federal Payments for 2023 are:

- $914 for an eligible individual

- $1,371 for a qualified individual and a qualified spouse

- $458 for an essential individual.

The amount of money you make each month from a job or other sources of income may reduce the maximum monthly SSI payment. You could get less money as a result, too. But SSI does not consider all forms of earnings.

Here are some examples of income that won’t count against,

- The first $20 a month that you earn or get from other sources

- The first $65 an individual makes each month, such as from a job

- The remaining earned income is split in half after cutting off $65 and the $20 exclusion.

Social Security Disability Benefits Pay Chart 2023

One might know how much pay they can anticipate getting from Social Security Disability by looking at the pay chart.

The amount you receive from your monthly benefit payout from Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) is an important consideration when qualifying for these programs.

One might know how much pay they can anticipate getting from Social Security Disability by looking at the pay chart.

The amount you receive from your monthly benefit payout from Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) is an important consideration when qualifying for these programs.

2021 | 2022 | 2023 | |

SSI Federal Payment Standard | |||

Individual | $ 794/mo. | $ 841/mo. | $913/mo. |

Couple | $1,191/mo. | $1,261/mo | $1,371/mo. |

Social Security Disability Thresholds | |||

Non-Blind | $1,310/mo. | $1,350/mo. | $1,470/mo |

Blind | $2,190 per mo. | $2,260/mo | $2,460/mo. |

SSI Resource Limits | |||

Individual | $2,000 | $2,000 | $2,000 |

Couple | $3,000 | $3,000 | $3,000 |

In 2023, retirees may expect a monthly payout of $1,827, up from $1,681 in 2022. However, the average monthly disability payment is raised by $119, from $1,364 in 2022 to $1,483 in 2023.

However, remember that the sum you receive each year as a benefit is subject to change based on the state of the economy and inflation.

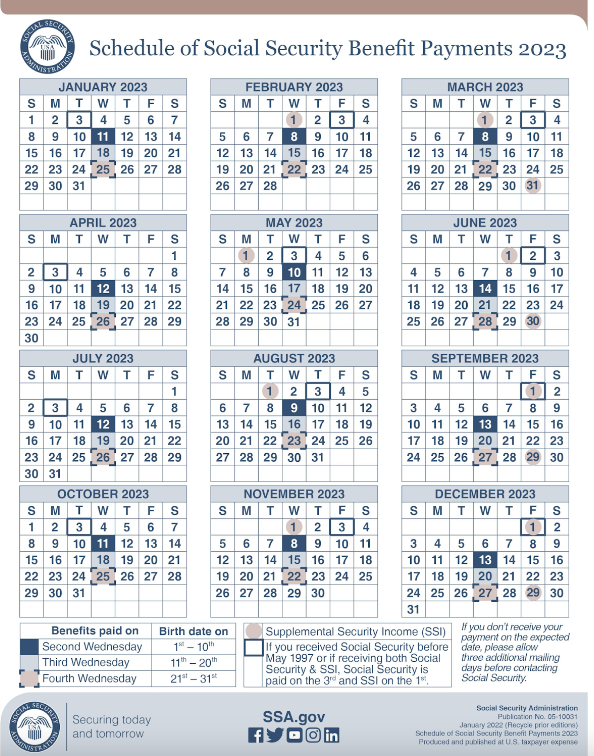

Social Security Disability Payments Schedule

The Social Security Administration also sets a yearly schedule for when disabled people will begin receiving their social security benefits.

The picture above displays the updated 2023 calendar with the revised payment schedule.

Based on your birth date, the Social Security Administration has scheduled monthly benefit payments for specific days of the month in 2023:

- Benefits are paid on the second Wednesday of the month if your birthday is between 1–10.

- Benefits are paid on the third Wednesday of the month if your birthday falls between 11–20.

- Benefits are paid on the fourth Wednesday of the month if your birthday is 21–31.

Using this schedule, you may plan accordingly for when your payment is due.

While most months’ worth of Supplemental Security Income benefits are sent out on the first of the month, January’s S.S.I. payments are typically issued on the last two business days of the prior month, on the 30th and 31st.

The maximum monthly benefit from Social Security

In 2023, the following are the highest possible monthly retirement, monthly SSDI benefit, and SSI payments:

- The highest monthly payment for Supplemental Security Income (SSI) is $914 for individuals and $1,371 for couples.

- The highest monthly Social Security Disability Insurance (SSDI) payment is $3,627.

- SSDI’s maximum family benefit is approximately 150 to 180 percent of the disabled worker’s benefit.

- The maximum monthly payment at full retirement age is $3,627. However, the benefit is $2,572 if you retire at age 62. Your benefit will increase to $4,555 if you retire at age 70.

Understanding the Payment Tiers

The Social Security Disability Benefits Pay Chart splits into various payment tiers, each representing a range of average lifetime earnings. As individuals advance through the categories, their payments increase. The objective is to provide higher benefits to those with lesser lifetime earnings because they may have more significant financial needs.

Social Security Disability Payments Pay Chart For Dependents

Although SSI does not provide benefits to dependents, it does pay monthly payments to “essential persons,” as the Social Security Administration defines them, who live with the SSI recipient and provide essential care. Such as a child who is a caregiver for an SDI benefits recipient.

Your qualifying family members may be eligible for SSDI benefits if you get them too. Those in your immediate family who could be eligible are:

- Eligible spouse/Divorced Spouse

- Children

- A young adult who got disabled before turning 22 years of age.

Since SSDI benefits are calculated monthly, the SSD benefits pay chart for children or dependents cannot establish the precise amount an eligible dependent receives.

Also, there is a maximum amount the Social Security Administration (SSA) will pay both you and your dependents from your SSDI benefits.

The total amount you and your dependents can receive is often between 150% and 180% of your SSDI benefit.

If you want to learn more about these monthly benefits, don’t miss out on this friendly guide about Social Security payments for spouses and dependents and their disability benefits.

Conclusion

Now that you have a clearer idea of what to expect from the Social Security Disability Benefits Pay, you can confidently go forward.

Stay up-to-date with any policy shifts that might affect your benefits by using official SSA resources, talking to specialists in Social Security disability, and keeping track of the news. Don’t forget to get help when needed and keep up with any modifications or updates to the SSD program.

If you plan and make smart decisions, you and your family’s financial futures may be safeguarded, and you can maximize the Social Security payments the administration provides.