As one reaches full retirement age, it becomes increasingly necessary to have a secure financial base.

Similarly, disabled seniors over 60 need to know how to use the Social Security Administration (SSA) system effectively and maximize their benefits.

The SSDI Guidelines assist but can be challenging for many to understand and follow.

The following article will examine how seniors might use the Social Security Disability Guidelines to maximize their monthly payments while ensuring their financial security and access to necessary assets.

Meeting the Disability Definition

The Social Security Administration (SSA) defines a person as disabled if they suffer from a major, medically determinable mental or physical condition that prohibits them from engaging in substantial gainful activity (SGA) and will likely last for at least one year or cause death.

To be eligible for disability benefits coverage, you must also have sufficient work credits.

These disability benefits are frequently provided to those under the age of 65, but we will go into great depth on the provisions for people 60 and over.

Benefits Available For Disabled Seniors.

Disabled seniors can find financial aid and social support through different programs and systems if they qualify for disability benefits.

- Social Security Disability (SSDI) Benefits– A program that provides monthly financial benefits to disabled individuals who have worked and paid Social Security taxes. These benefits help cover living and medical expenses.

- Supplemental Security Income (SSI)- Supplemental Security Income (SSI) is a needs-based program that provides monthly cash assistance to disabled individuals with limited income and resources.

- Medicare & Medicaid- Medicare is a federal health insurance program for individuals aged 65 and older, including disabled older adults receiving SSDI for at least 24 months. It provides essential medical services. In comparison, Medicaid is a joint federal and state health insurance program for low-income individuals, including seniors with disabilities. It may also cover Medicare-excluded long-term and residential health care.

- Veterans Administration (VA) Benefits- Veterans with disabilities may be able to get various benefits from the Veterans Administration (VA). These benefits include disability compensation, funding for medical treatment, support for housing, and long-term care of veterans.

- Other Benefits- Other benefits that can be available for disabled workers are house assistance benefits, Food assistance, and property tax relief, depending upon eligibility criteria.

Social Security Disability Rules After Age 60

However, some age-related considerations exist when applying for SSDI benefits after 60.

For instance, the Social Security Administration may see your limiting medical condition in an entirely different manner once you reach the age of 60, which can be considered under social security disability rules after age 60.

The different set of criteria is mentioned as Grid Rules, which can help people qualify for disability claims.

Your Age

The grid divides the claimant’s age into several age categories, starting at age 50 and going up to retirement age.

The age categories that the Social Security Administration uses are:

- Younger Individual (18-49)

- Close Approached Advanced Age (50-54)

- Advanced Age (55-59)

- Closely approaching Retirement Age (60-67)

Your Educational Background

Who can make a disability claim also depends on their education level. The less education you have, the more likely you will get in.

The Social Security Administration (SSA) made this a criterion because it is harder for less-educated people to find well-paying jobs.

The SSA divides education levels in the following way;

- High School education and skilled training for any job

- High school graduate or higher but no recent professional training

- Limited education level up to 11th grade and needs help to read or write.

Your Residual Functional Capacity/ FRC

The amount of mental and physical exertion you can undertake, also known as residual functional capacity on the job, is another factor Social Security considers when evaluating each applicant’s adaptability in the employment market.

From light to vigorous activity, RFC has five levels. Your ability to carry out tasks requiring physical and mental effort on the job will be classified according to the information found in your medical records. It will also evaluate the claimant’s transferable skills.

Your Past Work History

The SSA will examine your work history to determine if you can still work. But according to the SSA’s rules, “relevant work” is only work that has made enough money to be considered “substantial gainful activity.” For 2023, it will be 1,470 for disabled workers.

Experience from jobs paying less than $1,470 per month cannot be used.

Here is a small video explaining the grid rules by lawyer.

Notably, fulfilling these eligibility requirements does not guarantee approval for disability benefits. Therefore, submitting the required paperwork and undergoing a review by the SSA to determine eligibility are part of the application procedure.

Maximizing Social Security Disability Benefits After Age 60

There are many ways to maximize your Social Security benefits, but some are more challenging than others and might not work for you.

The following planning tips are ones that everyone should know about to increase the size of their Social Security checks.

Delayed Retirement Benefits

In general, the probability of qualifying for Social Security disability insurance benefits rises with advancing age, particularly once the individual reaches the age of 60.

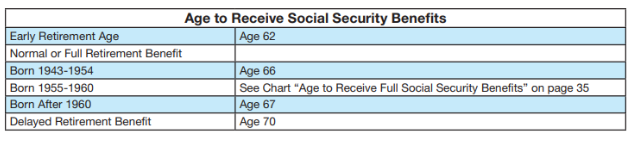

If you apply for Social Security retirement benefits before you reach retirement age, you will lose some of the benefits you would have gotten.

On the other hand, you can get Social Security disability benefits until you are 66, which is the age the government says most people can retire for good. It can result in a higher monthly retirement benefit amount.

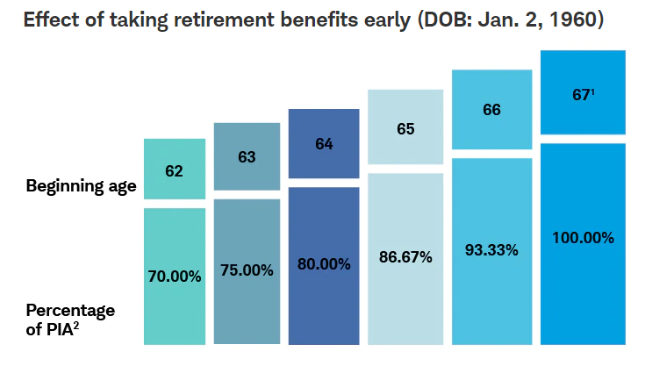

Avoiding early retirement and delaying benefits until age 70 can result in the highest quantity of benefits, almost up to 100%, also called delayed retirement credit.

For example, if you were born in 1960, your full retirement age would be 67. If you begin receiving benefits at age 69, you will receive a credit equal to 8% per year times two (the number of years you deferred).

Therefore, your benefit is 16% more than it would have been if you had received it at age 67. (There may be more inflation-related cost-of-living increases between ages 67 and 69, which are not included here.)

Coordination with Spousal Benefits

Suppose you’ve been married for over ten years, and your spouse gets disability and retirement benefits from Social Security. In that case, your family can also get assistance.

By coordinating your Social Security Disability payments with those of your partner, you can get the most money for your family.

For instance, one spouse may apply for spousal benefits while the other spouse delays submitting their disability benefits to receive delayed retirement benefits.

Consider Additional Sources of Income

You may strengthen your financial stability and minimize your dependency on Social Security payments by generating multiple income streams.

While SSDI payments can help, looking into other income opportunities is wise if they don’t cover all your bills.

Part-time jobs, investments, and other forms of retirement planning are viable alternatives.

Seek Professional Help

It might be challenging to make sense of the Social Security disability requirements, especially after 60. Consider consulting with a disability lawyer or advocate who has experience with Social Security disability benefits claims.

They will be able to steer you in the right direction, double-check your paperwork, and advocate on your behalf if an appeal or hearing is necessary.

There is plenty of valuable and expert advice for disabled workers who want to earn the highest disability benefits under 50.

Comparing Social Security Disability Insurance With Early Retirement

Taking early retirement and its benefits may look fascinating after age 62, and it may be a viable option for some due to the complex disability claim process. Still, it will permanently lower your benefits, and you would receive 30% less than the full benefit.

There are disadvantages to taking an early Social Security retirement instead of applying for disability benefits that should be considered before choosing this option.

If you apply for Social Security Disability Insurance (SSDI), you may receive disability benefits up to retirement age.

After receiving disability benefits until full retirement age, you will get your full Social Security retirement income for the rest of your life.

In addition, if you delay receiving Social Security retirement benefits until after your full retirement age, you will get a bonus known as a “disability freeze.“

That’s why it’s best to hold off if possible.

The Best Time to Apply for benefits

When deciding when to start receiving Social Security, keep the following in mind,

- Your Life Expectancy– The SSA reports an average life expectancy of 84-87 years for 65-year-olds, with a higher probability of at least one spouse living to 90. Consider waiting for increased monthly payments if you believe you’ll outlive the average life expectancy, or if you’re in poor health, take advantage of available resources. You can use the SSA’s life expectancy calculator to determine your life period.

- Your Financial Needs– If you’re considering retiring early and have enough money from investments, a standard pension, and other sources. You can choose when to start taking Social Security.

However, if you need your Social Security payments, you may not have fewer choices. To maximize your benefits, delay retiring or working part-time until your full retirement age or longer.

- Marital Status- If you’re married, consider your spouse’s age, health, and benefits, especially if they make more than you.

At full retirement age, you can get 100% of your benefits or 50% of your spouse’s. If you got divorced after ten years, you may be qualified to receive half of your ex-spouse’s Social Security retirement benefits.

Conclusion

Understanding and maximizing Social Security Disability rules as a person over 60 is essential for financial stability and access to needed resources.

You can make the application process go more smoothly if you maximize your disability benefits. Learn about the medical standards, plan for the costs, and do your research.

Always watch for new regulations, and don’t hesitate to get expert help if you get into trouble.